child tax credit 2021 october

CBS Detroit -- The Internal Revenue Service IRS sent out the fourth round advance Child Tax Credit payments on October 15. The 500 nonrefundable Credit for Other Dependents amount has not changed.

Families With College Students 18 24 Qualify For 500 Single Payment Under Biden S Child Tax Credit Extension

If parents alternate years claiming their child on their tax return the IRS said it will send the 2021 advance child tax credit payments to.

. October 29 2021 In October the IRS delivered a fourth monthly round of approximately 36 million Child Tax Credit payments totaling 15 billion. For tax year 2021 the Child Tax Credit increased from 2000 per qualifying child to. The IRS plans to issue direct deposits on the 15th of each month.

The Credit for Other Dependents is a tax credit available to taxpayers for each of their qualifying dependents who cant be claimed for the Child Tax Credit. Under the American Rescue Plan of 2021 advance payments of up to half the 2021 Child Tax Credit were sent to eligible taxpayers. Okay I had my granddaughter in my home from February 2021 to present.

I am claiming her on my taxes this year and I never claimed the Child T. In 2021 President Biden and Congress enacted the American Rescue Plan Act of 2021 which includes an update to the care credit which has remained essentially the same. Child Tax Credit and Other Depended Credit Excel WorksheetPlaylist.

Ad The new advance Child Tax Credit is based on your previously filed tax return. If you received advance payments you can claim the rest of the Child Tax Credit if eligible when you file your 2021 tax return. WASHINGTON The Internal Revenue Service and the Treasury Department announced today that millions of American families are now receiving their advance Child Tax Credit CTC payment for the month of October.

The American Rescue Plan which was signed in March of 2021 by President Joe Biden increased the existing child tax credit from 2K per child to 3K per child over the age of six and from 2K per child to 36K per child for children under the age of six. You can claim up to 500 for each dependent who was a US. IR-2021-201 October 15 2021.

The advance is 50 of your child tax credit with the rest claimed on next years return. Any updates made by August 2 will apply to the August 13 payment and all subsequent monthly payments for the rest of 2021. The monthly checks of up to 300 per child will continue through the end of 2021.

The couple would then receive the 3300 balance -- 1800 300 X 6 for the younger child and 1500 250 X 6 for the older child -- as part of their 2021 tax refund. The Child Tax Credit reached 611 million children in October and on its own contributed to a 49 percentage point 28 percent reduction in child poverty compared to what the monthly poverty rate in October would have been in its absence. 2021 payouts by age.

Resident alien in 2021. Read our child tax credit live blog for the very latest news and updates. Message designed for taxpayers claiming the child tax credit or earned income tax credit.

3000 for children ages 6 through 17 at the end of 2021. For the 2021 tax year only the child tax credit has been raised from the original 2000 child tax credit which was only sent for children age 16 or younger. The actual time the check.

In previous years 17-year-olds werent covered by the CTC. The CTC income limits are the same as last year but there is no longer a minimum income so anyone whos otherwise eligible can claim the child tax credit. In 2021 her mother received 180000 in child tax credit.

Advance Child Tax Credit Payments in 2021. As part of the American Rescue Plan Congress temporarily boosted the 2000 child tax credit to 3000 for income-eligible families for children ages 6 to 17 or 3600 for younger children. 2021 Child Tax Credit and Advance Payments.

Eligible families can receive a total of up to 3600 for each child under age 6 and up to 3000 for each one ages 6 to 17 for 2021. For 2021 the maximum child tax credit is 3600 per child age five or younger and 3000 per child between the ages of six and 17. And the credit was made refundable so families with little or no.

This fourth batch of advance monthly payments totaling about 15 billion is reaching about 36 million families. For the second half of 2021 payments were sent monthly to most eligible families. 3600 for children ages 5 and under at the end of 2021.

But as of yet the IRS Child Tax Credit Update Portal CTC UP still doesnt have the functionality to add a child born in 2021 although the IRS says it. Qualified children ages five and under may count for up to 3600 up to 300 per month from July through December. The age limit has also been increased.

The Expanded Child and Dependent Care Credit is a tax credit that can benefit you if you have children or other dependents to help you cover expenses related to their care. The fourth monthly payment of the expanded Child Tax Credit kept 36 million children from poverty in October 2021. October 15 2021 1242 PM CBS Chicago.

CBS Detroit --Most parents will receive their next Child Tax Credit payment on October 15.

December S Payment Could Be The Final Child Tax Credit Check What To Know Cnet

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities

Child Tax Credit 2021 8 Things You Need To Know District Capital

Did You File An Extension For Your Individual Tax Return You Have Until October 15 2021 To File Your In 2021 Accounting Services Small Business Accounting Irs Taxes

Child Tax Credit 2021 Payments How Much Dates And Opting Out Cbs News

Canada Child Benefit Ccb Payment Dates 2022 Loans Canada

Expiration Of Child Tax Credits Hits Home Pbs Newshour

Child Tax Credit Schedule 8812 H R Block

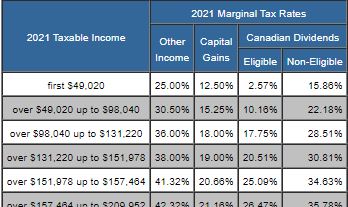

Taxtips Ca Alberta 2020 2021 Personal Income Tax Rates

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities

December S Payment Could Be The Final Child Tax Credit Check What To Know Cnet

Canada Child Benefit Ccb Payment Dates 2022 Loans Canada

Child Tax Credit Children 18 And Older Not Eligible Abc10 Com

2021 Child Tax Credit Calculator How Much Could You Receive Abc News

Child Tax Credit 2021 Payments To Be Disbursed Starting July 15 Here S When The Money Will Land Cbs News

Child Tax Credit 2021 Payments How Much Dates And Opting Out Cbs News

Taxtips Ca 2021 Non Refundable Personal Tax Credits Base Amounts

How To Claim The Child Tax Credit For A Baby Born In 2021 Goodrx

How To Claim The Child Tax Credit For A Baby Born In 2021 Goodrx